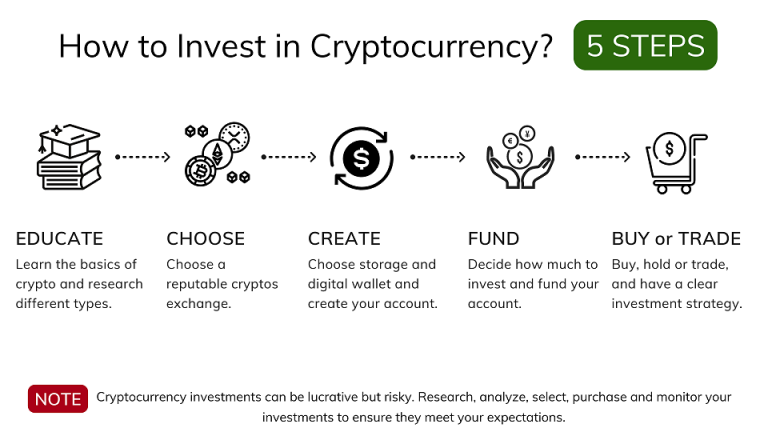

Are you interested in making your crypto holdings work for you while you sit back and relax? In this blog article, we will explore the world of passive income and how you can earn from your crypto investments. Discover the tips and tricks to maximize your earnings and take advantage of this exciting opportunity.

Ever dreamed of making money while you sleep? That’s what passive income is all about. It’s the money you earn from an endeavor where you’re not actively involved. Think along the lines of rental income, business partnerships, or investment dividends. The beauty of passive income lies in its minimal effort requirement. It’s like a goose laying golden eggs without you having to feed it every hour!

With the rise of digital currencies like Bitcoin, Ethereum, and their crypto-cousins, a whole new world of passive income generation has opened up. While traditional methods of generating passive income are like slow and steady tortoises, cryptocurrencies can be the hares, offering potential for high returns. Of course, these hares also come with their own set of hurdles (read: risks).

Now, let’s unwrap some of the ways you can earn passive income with cryptocurrencies:

Cryptocurrencies come with certain features that make them an ideal source of passive income.

Firstly, they’re like a global supermarket, highly accessible to anyone with an internet connection. No need for a hefty bank account to start investing.

Secondly, they offer the potential for high returns. It’s like playing the lottery, only with better odds (if you play it smart).

Thirdly, cryptocurrencies provide a smorgasbord of options for earning passive income. From staking to yield farming to running a master node, there’s something for everyone, regardless of their skill level or investment capacity.

Lastly, the crypto market is like the city that never sleeps, operating 24/7. So, you can make money while you’re dreaming about making money!

However, let’s not forget that with great rewards come great risks. The crypto market can be as volatile as a reality TV show. Therefore, it’s crucial to do your homework and perhaps seek advice from financial gurus before diving headfirst into crypto investments for passive income.

Crypto staking is a novel approach that gives investors the opportunity to pocket some passive income. Wondering how? Well, it all comes down to taking part in transaction validation on a proof-of-stake (PoS) blockchain. Think of it as being a silent partner in a busy pizzeria, but instead of dough and cheese, you’re dealing with PoS cryptocurrency. You store these digital assets in a wallet to boost the operations of a blockchain network, including its security and transaction validation. It’s like making the perfect pizza – you’ve got to have all the right ingredients! And just like that silent partner, you may get staking rewards that are similar to the interest you earn from traditional investments.

However, there’s always a flip side. Staking cryptocurrency isn’t all sunshine and rainbows. There are risks involved, like “slashing”, which is as menacing as it sounds. If a staker acts maliciously or fails to validate transactions correctly, a portion of their holdings may get slashed. Imagine it as a penalty for not playing by the rules. Also, given the volatile nature of cryptocurrencies, the value of staked assets and rewards can swing wildly. Plus, staked funds are typically locked for a period, limiting liquidity. It’s like having a treasure chest, but you’ve lost the key!

Let’s turn our gaze towards Bahrain, a country that has recently started to tango with crypto staking. Bahrain’s forward-thinking approach to fintech has established it as a hotspot for blockchain innovation in the Middle East. The Central Bank of Bahrain, through regulatory sandboxes, has allowed crypto-related projects to bloom like desert flowers after a rainstorm.

One such blooming project is ‘Project Staking,’ a blockchain startup that’s utilized Bahrain’s regulatory environment to launch a successful staking service. Using Ethereum 2.0, the startup empowers users to stake their Ether (ETH) and get rewards in return. It’s like planting a money tree and watching it grow!

By Q1 of 2021, ‘Project Staking’ reported an annual return of around 10% for its users, providing a significant passive income stream. However, during a market downturn, users saw the value of their staked ETH take a nosedive. But hey, the consistent returns from staking did manage to cushion the blow.

Bahrain’s experience with staking highlights how it can provide a consistent source of passive income, despite the associated risks. It also emphasizes the crucial role of regulatory support in nurturing such crypto-related initiatives. Who knows? The success of ‘Project Staking’ in Bahrain might serve as an inspiration for similar ventures around the globe.

Ever wondered how to make your cryptocurrency work harder than a beaver at a log rolling competition? Say hello to Yield Farming and Liquidity Mining. These cutting-edge strategies in the decentralized finance (DeFi) realm can help you earn passive income. Think of it as having your cake, eating it, and then getting a slice of someone else’s cake too.

Both techniques leverage the power of smart contracts – the self-executing contracts with the agreement’s terms directly coded. It’s like a robotic middleman, but one you can trust. The whole process is automated, leaving intermediaries out in the cold. In essence, yield farming and liquidity mining can turn your digital assets into money-making machines.

Yield Farming is like lending a good book to a friend, but in this case, you lend your crypto assets to a DeFi platform, and instead of a thank you, you get interest payments. The platform then uses these assets to fuel its operations, such as running a decentralized exchange or facilitating peer-to-peer lending. The interest you earn can vary, much like the quality of your friend’s book recommendations.

Now, Liquidity Mining is a different beast. It involves providing capital to a liquidity pool – these are smart contracts that hold funds. You know, like a piggy bank, but without the cute exterior. In return for your liquidity, you get rewards, which can come from fees generated by the DeFi platform or elsewhere. The more you give and the longer you leave it, the greater your returns. Talk about incentivizing generosity!

Like everything that promises high returns, yield farming and liquidity mining come with risks. The DeFi sector, though full of potential, is relatively new and has its fair share of unknowns. For instance, smart contracts might have vulnerabilities that could make them a hacker’s playground. Also, the regulatory environment for DeFi and cryptocurrency is still playing catch-up, which could impact the stability of your returns.

So, here are some survival tips:

In a nutshell, yield farming and liquidity mining are thrilling opportunities in the DeFi sector. They offer the potential for significant passive income, but they are not without risk. So, approach with caution, do your homework, and keep your eyes on the DeFi horizon.

Ever wondered what crypto lending platforms are? Well, think of them as digital matchmakers for the crypto world. They connect eager borrowers in need of crypto assets with lenders looking to squeeze some passive income out of their dormant cryptocurrencies. Acting as a bridge between the two, these platforms work tirelessly, 24/7, offering competitive interest rates. To protect our generous lenders, the lending process is usually backed by collateral. So, rest assured, your assets are safe (as long as the borrower doesn’t do a Houdini on you).

Crypto lending platforms come with their own set of pros and cons. For lenders, these platforms are like golden geese, providing a chance to earn passive income on idle crypto assets, with interest rates that traditional banks can only dream of.

For borrowers, it’s like having a genie in a bottle. They provide quick access to funds without the bureaucratic red tape of credit checks or never-ending approval processes. And yes, you can borrow in different cryptocurrencies. It’s like a crypto buffet!

But, like all buffets, you need to know when to stop. The crypto market is as volatile as a cat on a hot tin roof. If the value of the collateral takes a nose dive, borrowers could face a margin call, forcing them to cough up more funds or face the music with their collateral liquidation.

And then there’s the boogeyman of the digital world – cyber threats. Despite Fort Knox-like security measures, the risk of hacking always lurks in the shadows. Not to mention, the crypto industry’s notorious lack of regulation can sometimes feel like the wild west with potential transparency and accountability issues.

Choosing your crypto lending platform is like picking a needle in a haystack. Here’s a handy checklist to make your life easier:

Remember, crypto lending platforms can be a treasure trove of passive income, but only if navigated with a clear understanding of the potential rewards and risks. So tread carefully, matey!

A Master Node, in the mysterious world of cryptocurrency, is not just any server—it’s a server that does some heavy lifting. It’s like the wizard of Oz pulling the strings behind the curtain. This crypto wizard is essential to certain digital currencies such as Dash and PIVX, enabling cool features like lightning-fast or private transactions.

To become the wizard, or in crypto terms, to operate a Master Node, you need to put down a substantial amount of the cryptocurrency as collateral. It’s like a security deposit that incentivizes you to play fair and keep the network running smoothly. Once set up, Master Nodes are like diligent librarians, validating and recording transactions on the blockchain, and earning a share of block rewards for their efforts.

If you’ve ever wanted to earn money while you sleep, running a Master Node might be your golden ticket. It’s a source of passive income that could be quite lucrative, especially if the cryptocurrency’s value skyrockets. The income flows from transaction fees and block rewards. Plus, operating a Master Node is a bit like being part of an exclusive club—you often get voting rights on the future development of the blockchain.

But, as they say, with great power comes great responsibility (and risks). The entry ticket to the Master Node club can be steep, with some currencies asking for thousands of units to start a node. It’s a bit like buying a ticket for a rollercoaster ride—thrilling, but the value of your investment can go up and down with market conditions. Plus, operating a Master Node requires some tech-savviness and a reliable internet connection. You don’t want to be the guy who loses rewards because his internet went down.

Remember, setting up a Master Node is not for the faint-hearted—it’s a significant investment. Make sure you understand the risks and technical requirements. But with careful planning and a dash of tech knowledge, running a Master Node can be an exciting way to earn passive income with crypto. Don’t forget your wizard’s hat!