Are you curious about the future of banking and finance in Bahrain? Look no further than Decentralized Finance (DeFi), the innovative technology that is revolutionizing the industry. In this blog article, we will explore how DeFi is reshaping traditional banking practices, empowering individuals, and paving the way for a more inclusive and accessible financial system in Bahrain.

First off, let’s dive into Decentralized Finance, or as the cool kids call it, DeFi. What is it exactly? DeFi is an innovative and game-changing approach to finance that harnesses the power of blockchain technology to create an open, transparent, and intermediary-free financial system. Think of it as the financial service you use today — savings, loans, trading, insurance, you name it — but without the middleman and accessible to anyone with a smartphone and an internet connection. Yes, you heard it right, no more middlemen!

DeFi applications are built on blockchain platforms like Ethereum, handing the reins of control over assets to the users. Quite the contrast from the traditional financial systems, where institutions like banks and governments call the shots, right? By giving the middleman the boot, DeFi allows for speedier transactions, increased transparency, and improved financial inclusivity. Now, that’s what I call a financial revolution!

Moving on to Bahrain, the gem of the Middle East, which has been quick to jump on the DeFi bandwagon. With its forward-thinking approach towards fintech innovation, Bahrain has laid a solid foundation for the growth of DeFi.

Bahrain’s embracement of DeFi is part of its broader vision to position itself as the leading fintech hub in the Gulf region. How, you ask? By creating a supportive environment for fintech startups, leading to a boom in DeFi platforms and services. This has been made possible through a combination of robust infrastructure, friendly regulatory frameworks, and initiatives aimed at encouraging innovation in the fintech space.

Bahrain’s DeFi landscape is as vibrant as a rainbow, with several key players driving its growth and innovation. Let’s talk about a few:

Bahrain’s DeFi scene is also buoyed by several initiatives aimed at fostering its growth. For instance, the Central Bank of Bahrain has introduced a regulatory sandbox that allows fintech startups to test and develop their concepts in a controlled environment.

All in all, DeFi in Bahrain is experiencing rapid evolution, fueled by progressive regulations, supportive government initiatives, and a thriving ecosystem of innovative startups. And with this trajectory, Bahrain is on track to become a leading hub for DeFi in the Middle East and beyond. Now, isn’t that exciting?

Decentralized Finance or DeFi as the cool kids call it, is not just a buzzword in Bahrain’s banking sector. It’s the hot, new reality that’s transforming the financial landscape. This little piece of tech magic is ushering in a transparent, efficient, and inclusive era of financial services. And guess what? Bahrain is leading the charge on this front globally!

DeFi platforms in Bahrain are the banking equivalent of a magic carpet ride. They offer peer-to-peer transactions, cutting out the middleman, or as we know it, the traditional banks. It’s like having a financial genie granting wishes to everyone, regardless of their social or economic status. The use of blockchain technology in DeFi is like the secret sauce ensuring the enhanced security, transparency, and traceability of transactions. And let’s face it, who doesn’t love a little extra security?

DeFi is that party crasher in Bahrain’s traditional banking soiree that everyone ends up loving. It’s introducing a financial system that’s open to everyone and never sleeps. Unlike traditional banks that keep banking hours and respect geographical boundaries, DeFi platforms are the rebels, offering services like lending, borrowing, insurance, and asset management directly to the consumer.

What’s more, DeFi’s use of smart contracts – think of them as self-executing contracts with the terms written into code – allows for automated, transparent, and efficient transactions. This is leading to a flood of innovative financial products and services in Bahrain that are changing the way we interact with our money. It’s like your money got a cool, new upgrade!

Comparing DeFi and traditional banking in Bahrain is like comparing apples and oranges, they’re fundamentally different. Traditional banking, with its centralized system, is like a strict school principal, bogged down by numerous regulations and intermediaries. This often results in slower transaction times and higher fees.

In contrast, DeFi, the rebel, operates on blockchain technology, offering faster, cheaper, and more secure transactions. While traditional banks require you to dress up and present a pile of documents for access to financial services, DeFi platforms welcome anyone with an internet connection to join the financial market party. Plus, unlike traditional banks, DeFi platforms operate 24/7, letting you access your assets and execute transactions anytime.

However, it’s important to remember that DeFi, like any revolution, comes with its challenges, like regulatory concerns and technological complexities. But with Bahrain’s Central Bank’s progressive stance towards DeFi, it seems like the country’s banking future is all set to ride this wave of groundbreaking technology.

Ever wondered what’s revolutionizing the financial world in Bahrain? Well, meet Decentralized Finance (DeFi), the digital knight in shining armor. What’s it doing, you ask? It’s simply bulldozing barriers to financial services. By showing intermediaries the door, DeFi is now the new best friend of anyone with an internet connection.

The impact? Yuuuge! It’s a game-changer for the traditionally sidelined unbanked and underbanked populations in Bahrain. High costs, lack of documentation, or skepticism towards the banking system no longer hold them back. Thanks to DeFi, they’re now rubbing shoulders with the rest in activities like lending, borrowing, trading, and investing. Barriers? What barriers?

Here’s another reason to toast DeFi: It’s a hotbed of financial innovation. Thanks to the open-source DNA of DeFi platforms, they’re breeding grounds for experimentations and brand-new financial products and services. It’s like Willy Wonka’s chocolate factory, but for finance!

From stablecoins (that’s cryptocurrencies tied to stable assets like the good old US dollar), to yield farming (where users reap rewards for lending their assets), the range is breathtaking. And let’s not forget the role of smart contracts. These self-executing marvels, with the agreement terms coded into them, are automating financial transactions like never before.

Alright, let’s not get too carried away. DeFi is not without its share of drama. Bahrain’s financial sector has a few things to worry about. For starters, the lack of regulation and oversight makes DeFi a potential playground for fraudsters.

Then, there’s the technical complexity of DeFi platforms. If you’re not a techie, good luck figuring them out! And don’t get me started on the rollercoaster ride of cryptocurrency volatility.

But hey, every cloud has a silver lining. These challenges are also golden opportunities in disguise. For instance, the fraud risk can be countered with solid regulatory frameworks that ensure transparency and protect users.

As for the techie stuff, a little bit of user-friendly design and education can go a long way in helping people navigate the DeFi maze. And sure, cryptocurrencies are volatile, but they can also give you a run for your money (literally) if you’re game for the risk.

So there you have it. DeFi is certainly leaving its mark on Bahrain’s financial sector. It’s promoting financial inclusion, fueling innovation, and, despite a few hiccups, presenting loads of opportunities. As Bahrain tightens its embrace of DeFi, it’s going to be a wild, exciting ride to see how it reshapes the nation’s financial landscape. Buckle up, folks!

Let’s talk about the big guy in the room, the Central Bank of Bahrain (CBB). This heavyweight doesn’t just sit back and watch the DeFi show; it runs it! The CBB is at the forefront, regulating Decentralized Finance (DeFi) within the country, and they don’t take this responsibility lightly.

As the DeFi landscape evolves faster than a Ferrari, the CBB has hit the gas, ensuring a secure and transparent environment for both investors and businesses. And they mean business! Establishing regulatory guidelines, licensing DeFi companies, and carrying out regular audits, the CBB is like the strict but fair parent you can’t fool. Oh, and did I mention they can slap penalties on companies that don’t toe the line? Now that’s keeping the game fair and square!

So, what’s the current regulatory scene for DeFi in Bahrain? Well, it’s a bit like a teenager – still finding its feet. But the CBB hasn’t been twiddling its thumbs. They’ve already laid down some rules of the game.

Think of it like a theme park. Want to set up a ride (or in this case, a DeFi company)? Get a license first. You also need to maintain a certain level of capital and provide regular financial reports – no sneaky business here!

Plus, the CBB has some serious Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations in place. So, if you’re thinking of any hanky-panky, think again! It’s all about promoting transparency and preventing illegal activities. And yes, the CBB encourages DeFi companies to adopt internationally accepted best practices. Because, why not aim for the stars?

Now, you might think all these regulations are a buzzkill. But surprise, surprise! They’ve actually been a catalyst for the growth of DeFi in Bahrain. It’s like laying down the red carpet for businesses and investors, providing a sense of security and certainty. And guess what? International DeFi companies are loving it, choosing Bahrain as their go-to place for operations. Talk about a popularity contest!

Moreover, these regulations have managed to do what few can – instill confidence among investors. DeFi is no longer the new kid on the block but a safe and viable investment avenue. And when investors are happy, investments flow. However, every coin has two sides. The licensing requirements and capital maintenance rules may seem like a steep hill for small and medium-sized DeFi companies. Hence, it’s important for the CBB to keep tweaking its regulations to strike the right balance between growth and stability.

So, there you have it! The regulatory framework for DeFi in Bahrain in a nutshell. It’s a dynamic, ever-evolving landscape, but with the CBB at the helm, it’s definitely a journey worth watching.

Let’s be honest, Decentralized Finance (DeFi) is more than just the latest buzzword; it’s a whirlwind ready to transform the financial world. Especially in Bahrain, DeFi could be the golden goose of investment opportunities. Why, you ask? Well, the open-ended nature of DeFi, married with its cutting-edge innovations, make it a tantalizing prospect for any savvy investor. Plus, with blockchain technology underpinning it, DeFi offers transparency, security, and profitability in spades. This is all thanks to peer-to-peer transactions that remove the need for middlemen, cutting costs as a result. And the cherry on top? A boom in DeFi projects in Bahrain has led to a myriad of investment opportunities, from lending platforms to prediction markets. Now, who doesn’t love options?

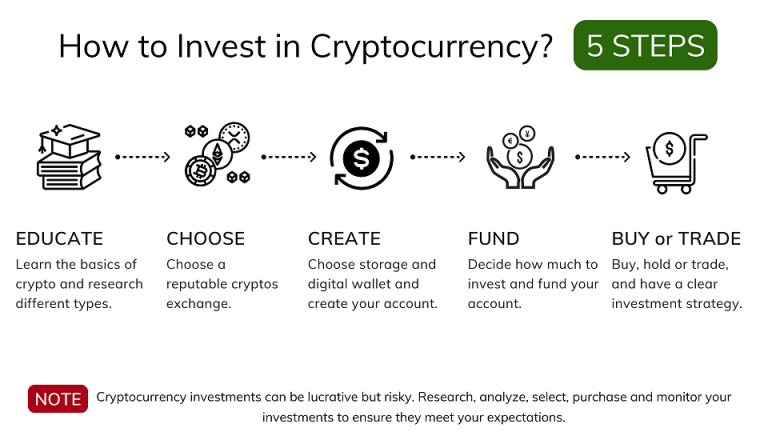

Ready to jump on the DeFi bandwagon? Here’s how you can start investing in DeFi projects in Bahrain:

As with any investment, DeFi has its fair share of pros and cons. On the bright side, DeFi can offer high returns. Its decentralized nature means it operates round the clock, offering constant opportunities for trading and earning. Plus, many DeFi platforms offer sweeteners like interest on deposits or rewards for providing liquidity.

But it’s not all rainbows and unicorns. DeFi does come with its own set of risks. First up, there’s smart contract risk. Since DeFi relies on these contracts to automate transactions, any bugs could lead to losses. Think of it as a computer glitch, but with potentially dire financial consequences. Then, there’s the roller coaster ride that is cryptocurrency price volatility. Plus, while Bahrain’s DeFi regulatory environment is evolving, uncertainties still loom that could impact market growth and stability.

So, while DeFi offers high potential rewards, it’s crucial for investors to understand the risks involved and take steps to mitigate them. Think of it like preparing for a hike – you’ll need to equip yourself with the right gear (diversifying investments), stay updated on weather conditions (market trends), and maybe even hire a guide (professional advice).

Remember, DeFi in Bahrain can be a lucrative investment opportunity, promising high returns and a chance to contribute to the growth of Bahrain’s financial sector. But as with any investment, it requires careful planning and risk management. With the right strategy, you can harness the power of DeFi to generate substantial returns. But remember, always invest responsibly!