If you’re interested in day trading in Bahrain’s crypto market, then you’re in for a wild ride. This lucrative field can provide great returns, but only if you’re prepared to put in the work and learn the ropes. In this blog post, we’ll explore some tips and tricks to help you succeed in the Bahraini crypto market.

Day trading has gained quite a reputation as a popular trading strategy, where traders buy and sell financial instruments (like cryptocurrencies) within the same trading day. The idea is simple: make a profit from small price movements throughout the day and close all positions before the market shuts down. This way, traders can avoid the risks associated with holding assets overnight when markets can go haywire.

When it comes to cryptocurrencies, day trading is all about speculating on the short-term price fluctuations of various digital currencies. Crypto day traders rely on technical analysis, chart patterns, and a variety of indicators to predict price movements and execute trades accordingly. And with the highly volatile nature of cryptocurrencies, day trading can be a rollercoaster ride of profits and risks.

Bahrain has been making waves as a regional leader in the adoption and regulation of cryptocurrencies. Thanks to its progressive approach to technology and financial innovation, the Central Bank of Bahrain (CBB) has put in place a comprehensive regulatory framework for crypto-assets. This includes licensing requirements for crypto exchanges and other service providers, which has attracted several international crypto exchanges to set up shop in the country.

But that’s not all! The Bahraini government is also promoting the use of blockchain technology and fostering a vibrant fintech ecosystem. This has piqued the interest of Bahraini investors, with many looking to diversify their investment portfolios and ride the crypto wave to potentially higher returns.

When day trading in Bahrain, picking the right cryptocurrencies to trade can make or break your success. Here are some major digital currencies that offer ample liquidity, volatility, and trading opportunities for day traders:

When selecting cryptocurrencies for day trading, remember to consider factors like liquidity, market capitalization, and trading volume. And most importantly, don’t forget to diversify your trading portfolio to spread risks and potentially maximize returns. After all, variety is the spice of life (and trading)!

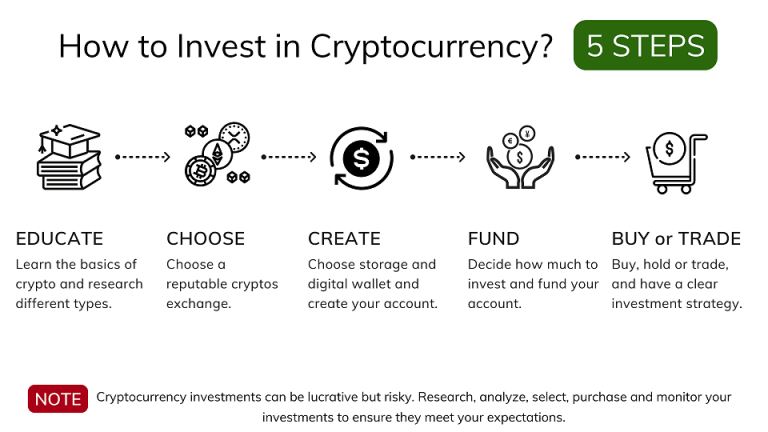

To kick off your crypto day trading adventure in Bahrain, your first mission is to find a trustworthy and dependable cryptocurrency exchange. This is your gateway to buying, selling, and trading cryptocurrencies. It’s essential to find an exchange that provides a user-friendly platform, low fees, and a secure trading environment. Some popular global exchanges to consider include Binance, Bitfinex, and Kraken. However, don’t forget to explore exchanges that cater to the Bahraini market, such as Rain, which holds the title of the first regulated crypto exchange in the Middle East.

When choosing an exchange, put on your detective hat and verify its security measures like two-factor authentication (2FA), cold storage, and insurance coverage for user funds. Don’t forget to investigate the platform’s trading fees, as they can significantly impact your profits. And finally, make sure the exchange offers a wide range of trading pairs and supports the cryptocurrencies you plan to trade.

Once you’ve found your ideal exchange, it’s time to create a digital wallet to store your cryptocurrencies. You’ll find various types of wallets out there, including hardware, software, and mobile wallets. Hardware wallets like Ledger and Trezor offer top-notch security, storing your private keys offline and keeping them safe from hackers. However, they can be a bit pricey and not as convenient for day trading purposes.

Software and mobile wallets, on the other hand, are more accessible and user-friendly but might not be as secure due to their online nature. Some popular options include Exodus, MyEtherWallet, and Trust Wallet. No matter which wallet you choose, always enable 2FA, use strong, unique passwords, and regularly update your wallet software.

Securing your wallet isn’t enough, though. You also need to practice safe storage of your recovery phrase or seed words. Think of these words as your wallet’s backup plan, allowing you to regain access in case of loss or theft. Store your recovery phrase in a secure, offline location, like a safe or a safety deposit box.

As a crypto day trader, it’s crucial to wrap your head around trading pairs, which determine which cryptocurrencies you can trade against each other on a specific exchange. For example, if you want to trade Bitcoin (BTC) for Ethereum (ETH), you would look for the BTC/ETH trading pair. The first cryptocurrency in the pair (BTC) is called the base currency, while the second (ETH) is known as the quote currency.

Exchanges typically offer various trading pairs, with some focusing on fiat-to-crypto pairs (e.g., USD/BTC) and others on crypto-to-crypto pairs (e.g., BTC/ETH). Familiarize yourself with the available trading pairs on your chosen exchange and identify those that offer the most liquidity and potential for profit.

When using trading pairs, keep a close eye on the bid and ask prices, which represent the highest price a buyer is willing to pay and the lowest price a seller is willing to accept, respectively. The difference between these prices is called the spread, and a tight spread is what you want, as it indicates high liquidity and lower trading costs.

To develop a winning day trading strategy, you’ll need to become best friends with various charting tools and indicators that can help you predict the market’s short-term movements like a fortune teller. The primary goal of technical analysis is to identify trends and patterns in the price action of cryptocurrencies.

Here are some popular charting tools and indicators used by day traders:

By understanding and applying these tools and indicators, you can make informed decisions about when to enter and exit trades, maximizing your profit potential like a seasoned pro.

While technical analysis focuses on price patterns and historical data, fundamental analysis is like detective work, examining the underlying factors that influence a cryptocurrency’s value. In the crypto market, these factors include:

By analyzing these factors, you can gain a deeper understanding of a cryptocurrency’s long-term potential and identify opportunities for profitable day trading like a master investor.

Risk management is a crucial aspect of day trading, as it helps protect your capital and minimize losses like an umbrella in a storm. One of the most effective risk management tools is the stop-loss order, which automatically closes a trade if the price reaches a predetermined level.

To set up a stop-loss order, consider the following steps:

By incorporating stop-loss orders and other risk management techniques into your day trading strategy, you can protect your capital and improve your chances of success in the volatile world of cryptocurrency trading like a seasoned sailor navigating stormy seas.

To be successful in the fast-paced world of crypto day trading, it’s crucial to stay informed about market updates and breaking news. Here are some of the top news sources to help you keep up with the latest developments in the cryptocurrency market:

Online forums and social media channels can be valuable resources for staying informed and discussing trading strategies with fellow crypto day traders. Here are some popular platforms to consider:

Becoming part of a local community can provide valuable support, networking opportunities, and knowledge sharing. Here are some ways to connect with local Bahraini crypto enthusiasts:

By staying informed through these essential resources, crypto day traders in Bahrain can make better-informed decisions, refine their trading strategies, and maximize their chances of success in the market.

Diversification is a crucial strategy in crypto day trading, as it helps to spread risk across various assets and reduce the potential for significant losses. By investing in a diverse range of cryptocurrencies, traders can mitigate the impact of market volatility on their portfolio. This is especially important in the highly unpredictable crypto market, where price fluctuations can occur within minutes.

To diversify effectively, traders should consider investing in a mix of large-cap cryptocurrencies, such as Bitcoin and Ethereum, and smaller altcoins that have potential for growth. Additionally, traders can explore different sectors within the crypto market, such as decentralized finance (DeFi) tokens or non-fungible tokens (NFTs). By spreading their investments across various assets, traders can capitalize on market opportunities while minimizing the risk of substantial losses.

To maximize profits and minimize losses in crypto day trading, it’s essential to avoid common mistakes that can hinder your success. Some of these mistakes include:

Staying disciplined and focused is essential for successful day trading in the crypto market. Here are some tips to help you maintain discipline and stay focused:

By following these tips and avoiding common mistakes, crypto day traders in Bahrain can maximize their profits and minimize losses. Diversification, risk management, and maintaining discipline are essential components of a successful day trading strategy. Stay focused on your goals, learn from your mistakes, and adapt to the ever-changing crypto market to increase your chances of success. And remember, even the most experienced traders have bad days, so don’t be too hard on yourself!