Cryptocurrencies have taken the world by storm, and mining them is a lucrative opportunity for those with the right equipment and know-how. In this article, we will explore the basics of cryptocurrency mining and provide you with tips on how to start making money with this exciting new technology. So, let’s dive in!

Cryptocurrency mining is the backbone of decentralized digital currencies like Bitcoin, Ethereum, and many others. It’s a process that generates new coins and validates transactions on a blockchain network by solving mind-boggling mathematical problems using computer hardware. In this virtual race, miners compete to crack these puzzles, and the winner gets rewarded with shiny new coins and transaction fees paid by users. So, it’s not just a nerdy pastime, but a crucial part of keeping the whole system secure and stable.

When it comes to mining cryptocurrencies, there are two primary methods to choose from: Proof of Work (PoW) and Proof of Stake (PoS).

PoW is the original gangster of mining methods, used by big players like Bitcoin and Ethereum. In PoW, miners flex their computational muscles, using powerful hardware like ASICs or GPUs, to solve complex mathematical problems. The first miner to solve the problem adds a new block to the blockchain and receives a reward in the form of newly minted coins and transaction fees. But it’s not all fun and games, as PoW requires a ton of computational power, making it a real energy guzzler.

PoS, on the other hand, is a more environmentally friendly alternative that doesn’t involve as much number-crunching. In PoS, the likelihood of validating a new block depends on how many coins a miner holds (their “stake”) instead of their computational power. The more coins you have, the higher your chances of being chosen to validate a block and earn the rewards. Some popular cryptocurrencies that use PoS include Cardano, Polkadot, and the upcoming Ethereum 2.0.

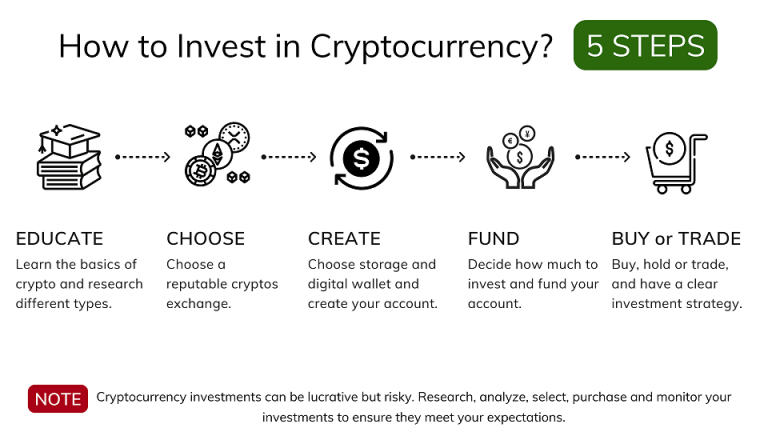

To sum it up, if you’re looking to venture into the world of cryptocurrency mining, it’s essential to understand the ins and outs of the process and the factors that can impact your profitability. Weighing the pros and cons of PoW and PoS mining methods, picking the right cryptocurrency, and managing expenses are all critical aspects of making sure you can keep mining those digital gold nuggets for the long haul.

When deciding on the right cryptocurrency to mine, it’s essential to compare the popular options and assess their potential profitability. Bitcoin, the most well-known cryptocurrency, is often considered the gold standard for mining. However, its high mining difficulty and competition may not make it the best choice for new miners.

Ethereum, the second-largest cryptocurrency by market cap, is another popular choice. With its shift from Proof of Work to Proof of Stake, Ethereum mining may become more accessible and potentially more profitable for miners. Other popular cryptocurrencies to consider for mining include Litecoin, Monero, and ZCash, each with its unique features and benefits.

When comparing these cryptocurrencies, consider factors such as:

Additionally, research each coin’s unique features, such as privacy or smart contract capabilities, to determine which aligns best with your interests and expertise.

Mining difficulty refers to the complexity of the mathematical problem that miners must solve to validate a block of transactions and receive the block reward. As more miners join the network and compete for the block reward, the mining difficulty increases to maintain a consistent rate of new blocks being added to the blockchain.

The network hash rate represents the total computing power of all miners on a blockchain network. As the hash rate increases, so does the mining difficulty, making it harder for individual miners to solve the complex mathematical problems and receive block rewards.

When choosing a cryptocurrency to mine, consider the mining difficulty and network hash rate to gauge potential profitability. Generally, a higher mining difficulty and network hash rate may result in lower profitability for individual miners due to increased competition. However, this can be offset by a higher coin value or more efficient mining hardware.

Another crucial factor to consider when choosing a cryptocurrency to mine is its future potential and longevity. A cryptocurrency with strong fundamentals, a clear use case, and a dedicated development team is more likely to succeed in the long run, potentially leading to higher rewards for miners.

To evaluate the future potential of a cryptocurrency, research its development roadmap, community engagement, and overall market sentiment. Look for coins with a clear vision, a strong and active community, and a history of consistent development progress.

Additionally, consider the regulatory environment surrounding a particular cryptocurrency. While regulations can change over time, it’s essential to be aware of any potential risks or challenges that may impact a coin’s long-term success.

When setting up your cryptocurrency mining rig, choosing the right hardware is crucial to ensure optimal performance and profitability. There are three main types of mining hardware: Application-Specific Integrated Circuits (ASICs), Graphics Processing Units (GPUs), and Central Processing Units (CPUs).

ASICs are specialized hardware designed specifically for mining a particular cryptocurrency. They are highly efficient and deliver unmatched performance for their intended purpose. However, they are expensive, have limited availability, and are only suitable for mining specific coins, making them less versatile.

GPUs, on the other hand, are more versatile and can mine multiple cryptocurrencies, including Ethereum, Litecoin, and others. Although not as efficient as ASICs, GPUs offer better flexibility and are more accessible to the average miner. High-end gaming GPUs are often used for mining, as they provide excellent processing power and can be easily resold if mining becomes unprofitable. Pro tip: If you’re a gamer, your GPU can make you some extra cash on the side!

CPUs are the least efficient option for mining, as they offer significantly lower processing power compared to GPUs and ASICs. However, they can be used for mining less competitive cryptocurrencies and are suitable for beginners who want to learn the ropes before investing in more expensive hardware.

To select the right mining hardware, consider factors such as the cryptocurrency you want to mine, your budget, and your long-term mining goals. And remember, choose wisely!

Mining software plays a crucial role in connecting your mining hardware to the desired blockchain network and managing the mining process. It is responsible for providing work to your mining rig, collecting the completed work, and submitting it to the network to receive rewards.

There are various mining software options available, each catering to specific hardware types and mining algorithms. Some popular choices include CGMiner, BFGMiner, and EasyMiner for ASIC mining, and Claymore, Ethminer, and PhoenixMiner for GPU mining.

When choosing mining software, consider its compatibility with your hardware, the supported mining algorithms, and the developer’s reputation. Additionally, ensure that the software offers user-friendly features, such as real-time monitoring, performance reporting, and automatic updates. Trust me, it’ll make your life easier!

Once you have selected your mining hardware and software, it is essential to configure your mining rig to achieve optimal performance and efficiency. Here are some tips to help you get started:

By carefully selecting the right hardware and software and configuring your mining rig for maximum efficiency, you can significantly increase your chances of success in the competitive world of cryptocurrency mining. So, let’s get mining!

A mining pool is like a dream team of cryptocurrency miners who join forces to boost their chances of mining a block on the blockchain network. By putting their computing powers together, they can significantly increase their hash power, which means a higher probability of mining success and rewards.

If you’re a miner with limited resources, joining a mining pool is a no-brainer. Here’s why:

There’s no shortage of popular mining pools to pick from, each with its own payout structure. Some of the big names in the game include:

When comparing mining pools, don’t forget to weigh factors like pool fees, payout systems, minimum payouts, and the pool’s reputation and stability. Your goal is to find a pool that aligns with your mining objectives and offers a fair, transparent payout structure.

To get the most bang for your mining buck, follow these tips:

By selecting the right mining pool, optimizing your hardware, and staying informed, you can maximize your earnings and enjoy a more stable, profitable mining experience. Happy mining!

Cryptocurrency mining is a power-hungry process, and keeping tabs on your mining rig’s electricity usage is vital for ensuring profitability. To work out your electricity expenses, you need to take into account three factors: the power consumption of your mining hardware, the cost of electricity in your area, and the number of hours your rig operates daily.

Start by figuring out your hardware’s power consumption, typically measured in watts (W). You can find this information on the manufacturer’s website or product specifications. Next, determine the cost of electricity in your area, which is usually billed in kilowatt-hours (kWh). Lastly, estimate how many hours your rig will run each day.

Multiply your hardware’s power consumption by the number of hours it operates to get the total daily power usage. Then, divide this number by 1,000 to convert it to kilowatt-hours (kWh). Multiply this by your local electricity rate to figure out your daily electricity cost. Keeping track of these expenses will ensure your mining earnings outweigh the electricity costs.

To guarantee the long-term success of your mining operation, it’s crucial to consistently monitor and maintain your mining equipment. Keep a close eye on your mining rig’s performance, including hash rate, temperature, and power consumption. Any significant drop in performance could signal hardware issues that need to be addressed promptly.

Dust and heat are common foes of mining hardware. Make sure to clean your mining rig regularly and ensure adequate airflow to prevent overheating. Replacing thermal paste and updating your hardware’s firmware can also enhance performance and extend its lifespan.

Lastly, always have a backup plan in case of hardware failure. Keep spare parts on hand and be prepared to replace any malfunctioning components to minimize downtime and maintain consistent mining output.

The cryptocurrency market is highly volatile and constantly evolving. To maximize your mining profits, it’s crucial to stay informed about market trends and adjust your mining strategy accordingly. Here are some tips for staying up-to-date and adapting to market changes:

By carefully managing your mining expenses, maintaining your equipment, and staying informed about market trends, you can ensure the profitability and long-term success of your cryptocurrency mining operation. Remember, the key to success in cryptocurrency mining is adaptability, diligence, and constant learning. And, as they say, “When the going gets tough, the tough get mining!”