Are you ready to cash out your cryptocurrency but unsure of the best practices to follow? Look no further! In this article, we have gathered expert advice on how to safely and efficiently cash out your digital assets, ensuring you maximize your profits while minimizing any potential risks.

In layman’s terms, cryptocurrency is a digital or virtual form of currency that employs cryptography for top-notch security. This makes it a tough nut to crack for counterfeiters and double-spenders. Unlike the traditional big guns like the US dollar or Euro, cryptocurrencies walk the path less trodden, they are decentralized. What’s driving them, you ask? It’s a fancy tech called blockchain, a distributed ledger enforced by a network of computers, or as we like to call them, nodes.

Cryptocurrencies aren’t just for show, they are designed to function as a medium of exchange. Each coin’s ownership record is stored in a ledger existing in the form of a computerized database. These databases use strong cryptography to secure transaction records, control the creation of additional coins, and verify the transfer of coin ownership. It’s all very James Bond, isn’t it?

The story began in 2009 with Bitcoin, the first of its kind. The brainchild of an anonymous person or group known as Satoshi Nakamoto. Bitcoin shook the financial world with the promise of lower transaction fees compared to traditional online payment mechanisms and, unlike government-issued currencies, it is operated by a decentralized authority.

Since Bitcoin’s dramatic entrance, numerous other cryptocurrencies have joined the party, often referred to as altcoins (alternative coins). You might have heard of Ethereum, Ripple, and Litecoin. Each one unique, like snowflakes in a blizzard. Some are clones of Bitcoin, others are forks, new cryptocurrencies that split off from an existing one. These altcoins have introduced a smorgasbord of features and opportunities, from advanced smart contracts and lightning-fast transactions to improved privacy.

Liquidity – now that’s a word that trips people up. It simply refers to how quickly an asset or security can be converted into ready cash without impacting its market price. When a cryptocurrency has high liquidity, it can be bought and sold at stable prices. In a highly liquid market, even heavy trading of a particular cryptocurrency won’t make its price go haywire.

Cryptocurrencies are considered pretty fluid as they can be readily converted into other coins or good old cash. However, the level of liquidity can vary. It depends on how popular the coin is, how secure it is, and how widely it’s accepted in mainstream commerce. For example, Bitcoin is often seen as one of the most liquid cryptocurrencies, thanks to its market capitalization, widespread acceptance, and integration with various financial systems.

Liquidity is a big deal in cryptocurrency. It influences how easy it is to convert crypto into cash, the prices, and the speed of transactions, which ultimately determines the financial stability and health of the market. A cryptocurrency’s liquidity can be affected by various factors, including the technology behind it, government regulation, market manipulation, and the coin’s utility. No one said this crypto business was going to be simple!

Deciphering the perfect moment to convert your cryptocurrency into cash is nothing less than a game of chess. It demands strategic moves and a cool head. Rule number one: don’t transform into a headless chicken and sell everything in a bear market. Let’s face it, cryptocurrencies are as unpredictable as weather forecasts – one moment it’s raining, the next, the sun’s shining.

In addition to keeping your nerves in check, it’s also crucial to keep an eye on the market trends and news that could significantly influence your cryptocurrency’s value. Did a new regulatory policy just drop? Or maybe a breakthrough in technology just hit the market? These could send your cryptocurrency’s value skyrocketing. So, keep your eyes peeled and cash out when you’re convinced the market has peaked – or when you’re just tired of the rollercoaster ride.

If you’ve ever had a rollercoaster ride, you’ll understand the cryptocurrency market’s volatility. Prices can shoot up or crash down faster than you can say “Bitcoin”. This can be both a boon and a bane. You could either be swimming in profits or sinking in losses.

The volatile nature of cryptocurrencies is largely due to their speculative nature. Unlike traditional assets, they don’t have physical assets or a reliable stream of cash flows to back their value. It’s like betting on a horse based on its jockey’s cool sunglasses. Hence, understanding this volatility is key to deciding when to cash out your cryptocurrency. If you’re not someone who enjoys a good thrill, it might be wise to convert your cryptocurrency into cash sooner than later.

Your financial goals are the puppet masters pulling the strings when it comes to deciding when to cash out your cryptocurrency. Hit your financial target due to a price surge? Might be a good time to cash out, especially if the market looks as stable as a house of cards.

Remember, cashing out your cryptocurrency isn’t about being a fortune teller who times the market perfectly. It’s about making an informed and strategic decision based on your personal financial goals and understanding of the market. And hey, if you do manage to time the market perfectly, let us know your secret!

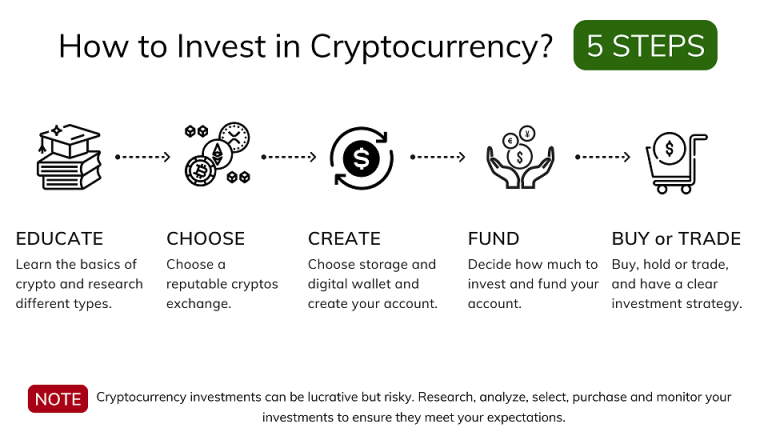

A popular kid on the block for converting your cryptocurrencies into good old cash is the Cryptocurrency Exchanges. These are your one-stop digital shops for swapping your cryptos for other currencies, be they digital or conventional.

There’s a lot to love about exchanges. Convenience, for starters. With a few clicks, you can convert your cryptos into cash, making it as easy as ordering a pizza. Not to mention, most exchanges come loaded with nifty features like secure wallets, advanced trading options, and a buffet of cryptocurrencies to choose from.

But, it’s not all rainbows and unicorns. Exchanges come with their share of party poopers. High transaction fees, security risks, and varying conversion rates can be a real downer. And when the market turns into a roller-coaster ride, exchanges can buckle under the pressure, delaying transactions and causing potential losses.

If exchanges don’t float your boat, Peer-to-Peer (P2P) trading might be your cup of tea. Instead of dealing with an exchange, P2P trading lets you trade directly with other users, like an online garage sale for cryptos.

P2P trading is like being your own boss. You choose who to trade with, at what rate, and how. Plus, you can skip the middleman, which could mean fewer fees. But, being the boss has its challenges. Finding a reliable trading partner can feel like finding a needle in a haystack. And watch out for the bogeyman – fraudulent traders. That’s why it’s crucial to pick a platform that offers an escrow service and a robust dispute resolution process.

For the high rollers dealing with hefty sums of cryptocurrency, Over-the-Counter (OTC) trading desks could be your best bet. Think of them like P2P trading on steroids, designed to handle transactions worth a pretty penny.

The charm of an OTC trading desk lies in its ability to curb slippage. Slippage is the crypto boogeyman that changes the price of a cryptocurrency when a large order is placed, giving you less bang for your buck. With an OTC desk, you can negotiate a fixed price for your entire order, banishing the boogeyman.

But, OTC desks aren’t for everyone. They usually require a high minimum trade amount, which can be a deal-breaker for small-scale traders. And while they might be slower than exchanges, they might not offer all cryptocurrencies for trade.

So, there you have it! Three ways to cash out your cryptocurrencies, each with its own pros and cons. Whether you opt for the convenience of exchanges, the control of P2P trading, or the large-scale capacity of OTC desks, the choice is as unique as your crypto portfolio. Happy trading!

In the wild west of cryptocurrency, new security threats pop up faster than a jackrabbit on a hot plate. Protecting your digital assets when converting cryptocurrency into cash is no joke. The first rule of thumb? Stick to trusted cryptocurrency exchanges. They’re like the Fort Knox of the digital world, with rigorous security measures to safeguard your precious cargo. Just remember not to park your assets there too long. Even Fort Knox has its vulnerabilities.

Two-factor authentication (2FA) is another tool in your security arsenal. Consider it your personal bodyguard, adding an extra layer of security to your wallet or exchange account and making it tougher for digital pickpockets to break in.

And let’s not forget about phishing scams. These sneaky swindlers are always fishing for a quick buck. Be sure to double-check the URLs of the sites you’re using, avoid suspicious links like they’re rattlesnakes, and never, ever share your private keys.

Cryptocurrency regulations are as diverse as a cowboy’s lasso tricks. What’s required in one place might get you in hot water in another. Some places demand cryptocurrency traders to report their transactions for tax purposes, while others put a tight rein on cryptocurrency exchanges.

Getting on the wrong side of these regulations can land you in a heap of trouble, so it’s essential to stay informed. Consider consulting with a financial advisor or legal expert familiar with cryptocurrency laws. They’ll help you navigate the tricky terrain of the legal landscape like a seasoned trail guide.

Converting cryptocurrency into cash is a lot like traditional currency exchange. Timing and rate comparison are key. Here are a few nuggets of wisdom to help you strike gold:

In this digital gold rush, cashing out your cryptocurrency safely means striking a balance between strong security measures, legal compliance, and smart conversion strategies. Stick to these best practices, and you’ll be well on your way to making the most of your cryptocurrency investments.

Bahrain’s cryptocurrency landscape is blossoming at an impressive pace, much to the credit of the government’s warm embrace of blockchain technology. The Central Bank of Bahrain (CBB) has rolled out a thorough set of rules tailored for cryptocurrency businesses, striking a perfect balance between fostering innovation and securing the interests of investors.

Bahrain is steadily carving out a niche for itself as a buzzing hub for blockchain startups, crypto exchanges, and fintech firms. The government’s nurturing regulatory ecosystem and its endeavors to mark its territory as a fintech powerhouse in the Middle East have caught the attention of international crypto companies looking to set up shop in Bahrain.

The Central Bank of Bahrain (CBB) is not just a spectator in this game. It has launched a comprehensive regulatory framework for cryptocurrencies. To operate, crypto businesses must hold a license and strictly adhere to guidelines set to safeguard consumers and uphold financial stability.

For example, cryptocurrency conversion is categorized under the Money Services umbrella, necessitating companies to align with the CBB’s rules for these services. These regulations are far-reaching, covering everything from minimum capital requirements to risk management, security protocols, and anti-money laundering provisions.

The silver lining here is that the CBB’s rules permit the conversion of cryptocurrency into fiat currencies, including the Bahraini Dinar. This green light has enabled licensed crypto exchanges to provide services for cashing out cryptocurrency in the country.

There’s no dearth of companies in Bahrain providing services to convert cryptocurrency into cash, all under the watchful eyes of the CBB. Let’s dive into some noteworthy options:

Before you zero in on a company to cash out your cryptocurrency, remember to do your homework, evaluate the transaction fees, and ascertain if the platform’s security measures are in line with your needs. Always stick to the law and stay updated on the latest regulations in Bahrain’s crypto scene. After all, knowledge is power, and in this case, it could be quite profitable too!