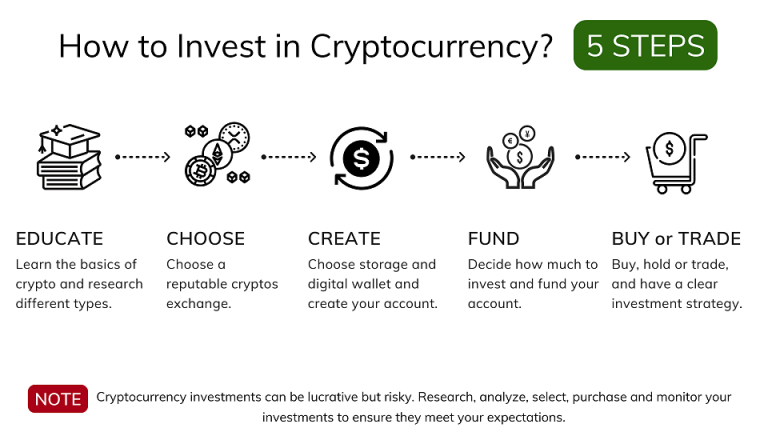

If you’re looking to invest in cryptocurrency in Bahrain, it’s important to have a solid strategy in place to maximize your returns. In this article, we will explore four expert tips for investing in crypto, including diversification, dollar-cost averaging, long-term holding, and staying informed. By implementing these strategies, you can increase your chances of success in the volatile world of cryptocurrency.

Ever heard of cryptocurrency? Of course, you have! It’s the digital version of a treasure chest, except it’s not buried on some deserted island. It’s been making waves globally with its decentralized nature, transparency, and the potential for high returns. Bahrain, a petite powerhouse in the Persian Gulf, is riding this wave like a pro. With its progressive financial policies, Bahrain has become the crypto capital of the Middle East. Let’s just say, the Bahraini folks are pretty crypto-crazy! They’ve been driving up crypto trading volumes like it’s going out of style.

And no, it’s not a free-for-all. Bahrain’s legal approach to cryptocurrency could give even the most modern countries a run for their money. In 2019, the Central Bank of Bahrain (CBB) blew the crypto whistle, setting out comprehensive rules for crypto assets and effectively giving a thumbs up to crypto trading. The CBB’s rulebook covers everything from licensing to risk management for crypto-asset services. Plus, with the support of Bahrain FinTech Bay, the country’s dedicated fintech hub, blockchain and cryptocurrency businesses are popping up like mushrooms after the rain.

But remember, with great power comes great responsibility. While crypto is legal, investors must stay on top of the regulatory landscape. This means doing your homework on crypto service providers and understanding the tax side of things. Let’s just say, you don’t want the taxman knocking on your door!

Now, for the juicy bit. Cryptocurrencies are like a rollercoaster ride – they can give you an adrenaline rush with their high potential rewards, but they come with their share of risks too. On the plus side, cryptocurrencies have been the golden goose for many. Bitcoin, the poster child of cryptocurrency, has turned many investors into millionaires. Other digital currencies like Ethereum, Ripple, and Litecoin aren’t far behind.

But don’t go putting all your eggs in one basket just yet. The crypto market is notoriously volatile. Cryptocurrencies can swing in value faster than a pendulum, meaning you could lose big as quickly as you could win. Add to that the risk of hacking and fraud due to their digital nature, and the possibility of regulatory changes shaking up the market, investing in crypto is not for the faint-hearted.

So there you have it, folks! The lowdown on cryptocurrency investment in Bahrain. As with any investment, do your research, stay updated on market trends, and maybe even seek advice from a financial guru before you dive headfirst into the exciting world of crypto!

Ever heard the saying, “Don’t put all your eggs in one basket”? Well, the same rule applies when you’re investing in cryptocurrencies. Throwing all your funds into a single cryptocurrency is like betting all your money on a single horse – risky, to say the least. With diversification, you spread your investment across various cryptocurrencies, effectively hedging your bets. So even if one coin decides to take a nosedive, the others might just soar, balancing out your potential losses. Remember though, diversification isn’t just about collecting as many coins as you can like some sort of digital pirate. It’s about investing in different types of coins with varying degrees of volatility and potential returns.

Are you a patient wolf waiting for the perfect moment, or a restless hawk that swoops in and out for quick profits? This is the difference between long-term holding and short-term trading. In crypto speak, we call long-term holding ‘Hodling’. With this strategy, you buy a cryptocurrency and hold onto it for several months or even years, hoping that it’ll skyrocket in value. It requires patience and a rock-solid belief in the long-term potential of the cryptocurrency.

Short-term trading, on the other hand, is like being in the middle of a frenzied stock exchange. You’re buying and selling cryptocurrencies within short periods, sometimes within a day, to profit from the volatile crypto market. It’s exciting, it’s nerve-wracking, and it requires a good understanding of market trends and the ability to make snap decisions. But remember, with great potential profits come great risks. Trade carefully!

Imagine being part of a new cryptocurrency right from the start, like being in on the ground floor of the next Bitcoin. This is what investing in Initial Coin Offerings (ICOs) can feel like. It’s like crowdfunding for new cryptocurrencies, where you get the chance to buy tokens at a lower price before they’re listed on crypto exchanges. But be warned, just like in the wild west of startups, many ICOs turn out to be busts or scams. So, before you put your hard-earned money into an ICO, do your homework. Research the project, the team behind it, and its potential for success.

Now, this is where it gets really interesting. Automated trading bots are like having your own personal Wall Street trader, working round the clock. These bots use algorithms to buy and sell cryptocurrencies based on predefined rules and market trends. They’re like the Terminator of trading, reacting faster to market changes than any human trader could. But just like Arnie’s character, they’re not without their flaws. If the bot’s algorithm isn’t well designed, or if the market goes rogue, the bot could make poor trades, leading to losses. So, choose your bot wisely and keep an eye on its performance.

Did you know that Bahrain, a tiny yet tech-savvy nation, has been smitten by the cryptocurrency bug? Yes, you heard that right! Bitcoin, the granddaddy of all cryptos, enjoys a massive fan following here. Not far behind is Ethereum, the favourite among the tech connoisseurs, thanks to its nifty smart contract feature. Then there’s Ripple’s XRP, the darling of those who value real-time, low-cost international money transfers. But wait, the party doesn’t stop there! Litecoin, Bitcoin Cash, and Dash are the new kids on the block, earning a reputation among Bahraini investors for their tech prowess and growth potential.

Alright, let’s get down to brass tacks. Choosing the right cryptocurrency for investment is no less than solving a Rubik’s cube. Here’s what you need to keep in mind:

When it comes to emerging cryptocurrencies, it’s like exploring uncharted territory. It’s fraught with risks but also brimming with opportunities. Remember the early investors in Bitcoin or Ethereum? They’re probably on a beach somewhere, sipping on piña coladas.

However, don’t let that fool you. Investing in new cryptos is like walking on a tightrope. Many fail to deliver on their promises or stumble into regulatory roadblocks. Plus, the crypto market’s volatility can turn your investment into dust overnight.

So, if you’re thinking about investing in emerging cryptocurrencies, do your homework. Scrutinize the project’s whitepaper, understand its use case, evaluate the technology, and vet the team. And remember, never bite off more than you can chew. It’s always wise to spread your investment across different cryptocurrencies to hedge your bets.

Investing in cryptocurrencies is not for the faint-hearted. It’s a rollercoaster ride with highs that can reach the stratosphere and lows that can plunge you into the abyss. So, tread carefully, stay informed, and most importantly, never lose sight of the risks involved. After all, as they say in the crypto world, “Don’t invest more than you’re willing to lose”. Wise words, indeed!

Did you know that Bahrain is a thriving tech hub in the Middle East, particularly for fintech? And it’s not all about camel races and pearls, my friends. Bahrain boasts of hosting a plethora of top-tier cryptocurrency trading platforms. Leading the pack is Rain, a licensed cryptocurrency exchange by the Central Bank of Bahrain. It’s like the Usain Bolt of crypto exchanges – fast, reliable, and popular. With a user-friendly interface and a security system as solid as the Bahrain Fort, it’s no wonder Rain is a hit among local investors.

Following closely is Binance, the Godzilla of the cryptocurrency world. Not just a global giant, Binance also serves the Bahraini investors. It’s like the Amazon of cryptocurrencies – offering a vast range of crypto options, cutting-edge trading features, and it’s known for its exceptional liquidity.

Let’s not forget Kraken, another crowd-pleaser. It’s like the Fort Knox of crypto platforms, known for its rock-solid security protocols and a smorgasbord of crypto assets.

Choosing a cryptocurrency trading platform is like picking a restaurant. There are several key features you should consider.

Securing your crypto assets on trading platforms is like a tango – it takes two. Both you and the platform play vital roles.

In a nutshell, Bahrain offers an array of secure and efficient crypto trading platforms. But remember, it’s essential to do your homework, understand the platform’s features, and take active steps to safeguard your crypto assets.

In the electrifying, roller-coaster ride that is the world of cryptocurrency, staying clued up on global trends isn’t just a good idea—it’s survival. Cryptocurrency values are as unpredictable as a cat on catnip, affected by everything from tech breakthroughs and regulatory shifts to market sentiment and global economic roller coasters. By keeping your ear to the ground, you can predict potential market swings and make smart, informed investment choices.

Staying in the loop with global crypto trends also lets you spot new opportunities and risks before they spot you. For example, hearing that a country like Bahrain is rolling out the red carpet for crypto could be your cue to invest. On the flip side, news of regulatory clampdowns in other countries might be your warning to pull out or shuffle your investments around. So, staying informed is your compass in the stormy seas of crypto.

There’s no shortage of resources for keeping up with crypto market trends. Websites like CoinDesk and Cointelegraph are your one-stop shops for deep-dives into the crypto universe. For real-time price updates, platforms like CoinMarketCap and CryptoCompare are your new best friends.

Crypto-specific forums and social media platforms are like an Aladdin’s cave of information. Reddit’s r/CryptoCurrency and r/Bitcoin communities are buzzing with discussions on the latest happenings. Twitter is another platform where many crypto gurus share their wisdom and crystal ball predictions.

Even traditional financial news outlets like Bloomberg and CNBC now have sections dedicated to cryptocurrency news. They offer a more conventional take on the crypto market, complete with expert analyses and interviews.

Predicting market swings is as tricky as eating soup with a fork, thanks to the volatile nature of cryptocurrencies. But, there are a few strategies that can help.

But remember, predictions are about as reliable as a chocolate teapot. The crypto market is wildly unpredictable, and even the savviest investors can slip up. So, always consider your financial situation and risk tolerance before placing your bets.