Are you interested in buying cryptocurrency in Bahrain? Timing is crucial when it comes to investing in this volatile market. In this article, we provide expert insights and market analysis to help you determine the best time to buy cryptocurrency in Bahrain.

Bahrain, a small island country in the Arabian Gulf, has been witnessing a significant growth in the cryptocurrency market. With its strategic location and a tech-savvy population, Bahrain has emerged as a regional hub for financial technology and digital innovation. The cryptocurrency market in Bahrain is characterized by a diverse range of digital currencies, including Bitcoin, Ethereum, Ripple, and Litecoin, among others.

As the global interest in cryptocurrencies continues to rise, many Bahraini investors and traders are actively participating in this digital revolution. The country’s advanced technological infrastructure, coupled with a favorable regulatory environment, has encouraged the growth of local cryptocurrency exchanges and blockchain-based startups.

The adoption of cryptocurrencies in Bahrain has been on a steady upward trajectory in recent years. This growth can be attributed to several factors, including:

Moreover, the Bahraini government’s push for digital transformation and economic diversification has played a crucial role in fostering the growth of the cryptocurrency market. For instance, the launch of Bahrain Fintech Bay, a dedicated fintech hub, has facilitated the growth of numerous startups and businesses focused on blockchain and cryptocurrency technologies.

Another factor contributing to the growth of cryptocurrency adoption in Bahrain is the increasing number of merchants accepting digital currencies as a payment method. This trend not only showcases the growing acceptance of cryptocurrencies but also offers a practical use case for everyday transactions, further promoting their adoption among the general public.

The regulatory landscape for cryptocurrencies in Bahrain is relatively progressive compared to other countries in the region. The Central Bank of Bahrain (CBB) has been proactive in developing and implementing a comprehensive regulatory framework for digital assets, with a focus on fostering innovation while ensuring consumer protection and financial stability.

In 2019, the CBB introduced comprehensive rules for cryptocurrency businesses, covering areas such as:

These regulations have created a transparent and secure environment for cryptocurrency businesses to operate in, attracting both local and international players to the Bahraini market.

Furthermore, the government of Bahrain has been supportive of the growth of the cryptocurrency market. Initiatives such as the Bahrain Economic Development Board (EDB) and the Bahrain Fintech Bay provide a conducive ecosystem for startups and businesses in the digital asset space, offering resources, mentorship, and funding opportunities.

So, when is the best time to buy cryptocurrency in Bahrain? Well, that’s the million-dollar (or should we say, million-Bitcoin) question! Keep an eye on market trends, stay informed, and don’t forget to have a little fun along the way. After all, it’s not every day that you get to be a part of a digital revolution!

Market trends play a significant role in determining the best time to buy cryptocurrency. Getting a grasp on these trends can help investors make informed decisions and maximize their potential returns. There are generally three market trends to consider: bullish, bearish, and sideways.

A bullish market is characterized by rising prices and increased investor confidence. In this scenario, it is generally a good time to buy cryptocurrency, as prices are expected to continue increasing. Investors should look for entry points during price dips to maximize their gains. It’s like buying your favorite ice cream at a discount!

On the other hand, a bearish market is marked by falling prices and diminished investor confidence. This may not be the best time to buy cryptocurrency, as prices are expected to decline further. However, savvy investors can take advantage of this situation by purchasing undervalued cryptocurrencies and holding them for the long term, anticipating a future market recovery – think of it as a long-term treasure hunt!

A sideways market is characterized by stable prices and low volatility, with no clear direction. In this case, investors can consider employing different strategies, such as dollar-cost averaging or short-term trading, to take advantage of minor price fluctuations.

Cryptocurrency prices can be heavily influenced by global economic events, making it crucial for investors to stay informed about these occurrences. Some of the most impactful events include:

Cryptocurrency investments come with inherent risks due to the market’s volatility. Here are some strategies for managing these risks:

By understanding market trends, the impact of global economic events, and employing risk management strategies, investors can make more informed decisions when buying cryptocurrency. This knowledge will not only help to maximize potential returns but also minimize potential losses in the ever-evolving world of cryptocurrencies.

When it comes to the best time to buy digital currencies, cryptocurrency experts and analysts often have differing opinions. However, there are a few general principles that most experts agree on. One such principle is to buy during a market dip, when the prices of cryptocurrencies are low. This allows investors to take advantage of lower prices and potentially make higher profits when the market recovers.

Another common recommendation from experts is to pay attention to the overall market sentiment. Positive news about cryptocurrency adoption, regulatory changes, and technological advancements can often lead to an increase in market prices. Investors who stay informed about these events may be able to anticipate market trends and make strategic investment decisions.

Bahrain has seen several successful cryptocurrency investments in recent years, which can serve as examples for new investors. One such case is a Bahraini investor who purchased Bitcoin in 2015 when the price was around $300. As the value of Bitcoin skyrocketed to nearly $20,000 in 2017, the investor was able to make a significant profit by holding onto their investment.

Another case study involves a Bahraini entrepreneur who decided to invest in Ethereum during its early stages. The entrepreneur purchased Ethereum at approximately $10 per coin in 2016. As Ethereum’s value increased to over $1,000 in 2018, the investor reaped substantial returns on their investment.

These cases illustrate the importance of long-term thinking and patience when investing in cryptocurrencies. By researching potential investments and buying during periods of low prices, these investors were able to capitalize on the growth of the cryptocurrency market.

To make informed decisions about when to buy cryptocurrency in Bahrain, investors should utilize various tools and resources to track and analyze market trends. Some popular tools and resources include:

By using these tools and resources, investors in Bahrain can stay informed about the ever-changing cryptocurrency landscape and make better decisions about when to buy and sell their digital assets. Remember, knowledge is power, and in the world of cryptocurrency, it’s also profit!

Dollar-cost averaging (DCA) is a clever investment strategy perfect for those who want to play the long game. It involves consistently buying a fixed amount of cryptocurrency at regular intervals, regardless of the market price. This approach is particularly suitable for long-term investors who want to minimize the impact of market volatility on their investments.

By employing DCA, investors in Bahrain can accumulate cryptocurrency over time while averaging out the cost of their investments. This can help to reduce the impact of short-term price fluctuations and mitigate the risk of making a poorly-timed investment. To implement this strategy, simply decide on a fixed amount you’re comfortable investing, and set a regular interval (e.g., weekly or monthly) to purchase cryptocurrency. This disciplined approach can lead to more consistent returns and a stronger overall investment performance in the long run.

While long-term investors might prefer the DCA approach, short-term traders in Bahrain can also benefit from a variety of trading strategies designed to capitalize on market fluctuations. One such strategy is technical analysis, which involves studying price charts and historical data to identify patterns and trends that can inform trading decisions.

Technical analysis can help traders in Bahrain predict potential price movements and make informed decisions about when to buy or sell cryptocurrency. This approach may include the use of various indicators, such as moving averages, Relative Strength Index (RSI), and Fibonacci retracement levels, to identify potential entry and exit points for trades.

Another short-term trading strategy is fundamental analysis, which involves examining the underlying factors that affect the value of a cryptocurrency, such as news events, regulatory changes, and market sentiment. By staying informed about these factors, traders in Bahrain can make more informed decisions about when to buy or sell cryptocurrency based on expected price movements.

Diversification is a key principle of investing, and it applies to cryptocurrency investments as well. By investing in a diverse range of cryptocurrencies, Bahraini investors can reduce the overall risk of their portfolio, as different cryptocurrencies may respond differently to market events and trends.

When diversifying a cryptocurrency portfolio, consider investing in both established coins like Bitcoin (BTC) and Ethereum (ETH), as well as newer, lesser-known cryptocurrencies with strong potential for growth. It’s also important to consider the unique features and use cases of each cryptocurrency, as this can provide further diversification benefits.

In addition to diversifying across different cryptocurrencies, Bahraini investors can also diversify their investments across various sectors within the blockchain industry. For example, you may choose to invest in cryptocurrencies that focus on decentralized finance (DeFi), data storage, or gaming, among others. This can help to further spread risk and enhance potential returns.

Remember that diversification is not a guarantee against losses, but it can help to reduce the overall risk of your cryptocurrency investments. As with any investment strategy, it’s crucial to do thorough research and carefully consider your risk tolerance before making any decisions.

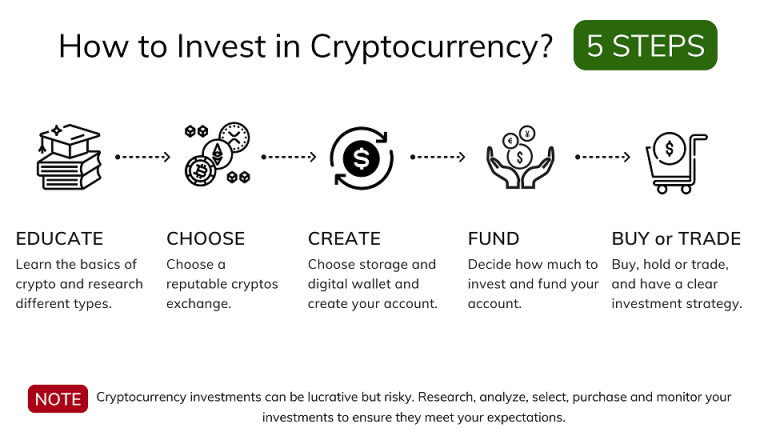

Embarking on your crypto journey in Bahrain? The first step is to pick a trustworthy and reliable cryptocurrency exchange. A top-notch exchange should offer a vast range of cryptocurrencies, charge low fees, provide user-friendly platforms, and maintain high security standards.

Some well-known exchanges operating in Bahrain are Rain, Binance, and Kraken. To make the best decision, it’s crucial to research and compare the different exchanges based on their reputation, fees, supported cryptocurrencies, and user reviews. Don’t forget to also consider the availability of customer support and the ease of withdrawing and depositing funds in your local currency. Because, let’s face it, who wants to deal with a customer support that takes ages to respond?

Once you’ve picked a suitable cryptocurrency exchange, the next step is to set up a secure wallet to store your digital treasures. A cryptocurrency wallet is a digital tool that lets you securely store, send, and receive cryptocurrencies. There are various types of wallets, including hardware wallets, software wallets, and web-based wallets.

Hardware wallets, like the Ledger Nano S or Trezor, are considered the Fort Knox of wallets as they store your private keys offline, shielding your assets from potential hacks. Software wallets, such as Exodus or Atomic Wallet, are apps that can be installed on your computer or smartphone. They strike a good balance between security and convenience but may be susceptible to malware attacks.

Web-based wallets can be accessed through a browser and are usually offered by cryptocurrency exchanges. While they’re convenient for frequent traders, they are less secure since they store your private keys online.

Remember, the security of your wallet is vital to protect your investments. Always use strong and unique passwords (not “password123”), enable two-factor authentication, and backup your wallet regularly.

To make well-informed decisions about your cryptocurrency investments, you need to stay updated on the latest trends, news, and developments in the industry. Here are some tips to help you stay in the loop on cryptocurrency trends in Bahrain:

By following these tips, you can stay well-informed about the cryptocurrency market in Bahrain and make better decisions when it comes to buying, selling, or trading digital assets. Good luck, and may the crypto gods be with you!