If you’re looking to invest in cryptocurrencies in Bahrain, choosing the right broker can be a crucial decision. With so many options available, it’s important to consider factors like fees, security, and reputation to ensure you’re working with a trustworthy and reliable platform. In this article, we’ll explore some tips and considerations to help you choose the right crypto broker in Bahrain.

Witnessing significant growth in recent years, the cryptocurrency market in Bahrain has truly blossomed. Thanks to a tech-savvy population and a government that actively encourages innovation and entrepreneurship, Bahrain has emerged as a hub for blockchain and cryptocurrency startups in the Middle East. Consequently, the demand for reliable and trustworthy crypto brokers has increased, making it essential for traders to choose the right platform to meet their needs and preferences.

Before diving into the world of crypto trading in Bahrain, it is crucial to understand the dynamics of the local market. The Bahraini cryptocurrency ecosystem is characterized by a mix of local and international players, offering various services ranging from exchange platforms to wallet services and blockchain solutions. Additionally, several investment opportunities are available for traders, including trading in popular cryptocurrencies like Bitcoin, Ethereum, and Ripple, as well as emerging altcoins.

Fortunately for traders, the legal framework for cryptocurrency trading in Bahrain is relatively well-developed. The Central Bank of Bahrain (CBB) has introduced a comprehensive set of regulations to govern the activities of crypto-asset service providers, making Bahrain one of the first countries in the region to establish a clear regulatory framework for the industry.

The CBB’s regulations cover various aspects of cryptocurrency trading, including:

Crypto brokers operating in Bahrain must adhere to these regulations and obtain the necessary licenses from the CBB, ensuring a safe and secure environment for traders.

Additionally, the CBB has introduced a regulatory sandbox to support the development of innovative fintech solutions, including blockchain and cryptocurrency services. This initiative allows companies to test their products and services in a controlled environment, enabling them to refine their offerings before launching them in the market.

The Central Bank of Bahrain plays a crucial role in ensuring the stability and integrity of the country’s financial sector, including the cryptocurrency market. As the primary regulator of crypto brokers in Bahrain, the CBB is responsible for overseeing their operations, ensuring compliance with relevant regulations, and protecting the interests of traders.

To achieve these objectives, the CBB has established a dedicated fintech and innovation unit that monitors the activities of crypto brokers and other fintech service providers. This unit is responsible for conducting regular inspections, reviewing the performance of licensed brokers, and taking enforcement action against those who fail to comply with the regulations.

Moreover, the CBB plays a vital role in promoting transparency and accountability in the cryptocurrency market. Crypto brokers are required to submit periodic reports to the CBB, detailing their financial performance, risk management practices, and adherence to AML/CFT measures. This information enables the CBB to assess the overall health of the market and take appropriate action to safeguard the interests of traders.

By taking these factors into account, traders can make an informed decision and select a platform that best aligns with their trading goals and risk appetite. And who knows, with the right crypto broker by your side, you might just become the next cryptocurrency mogul in Bahrain!

When selecting a crypto broker in Bahrain, you should always prioritize their reputation and credibility. A trustworthy broker should boast a proven track record and a solid reputation within the industry. You can assess this by exploring online reviews, forums, and social media platforms where traders discuss their experiences and opinions on various brokers. Additionally, keep an eye out for any awards or recognitions the broker may have received from reputable industry organizations. Opting for a broker with a strong reputation is crucial, as it demonstrates their dedication to providing top-notch services and a reliable trading environment.

Security measures are of paramount importance when choosing a crypto broker in Bahrain. A secure platform should employ industry-standard security protocols, such as two-factor authentication, encryption, and secure socket layer (SSL) technology. Furthermore, the broker should have a transparent policy on handling user funds, including segregation of client funds from the broker’s operational funds and holding funds in reputable banks. Last but not least, the broker should have an impeccable track record of protecting user data and funds from hacking attempts and other security breaches.

The variety of cryptocurrencies and trading pairs available on a broker’s platform is another crucial factor to consider. A wider range of trading pairs means more opportunities for diversification and profit-making. Before selecting a broker, ensure that they offer the cryptocurrencies and trading pairs you’re interested in trading. Some brokers may only provide access to popular cryptocurrencies like Bitcoin and Ethereum, while others may offer a more extensive selection of altcoins and trading pairs. Remember, it’s essential to choose a broker that caters to your specific trading needs and preferences.

Trading fees and costs can significantly impact your overall profitability as a crypto trader. To avoid any nasty surprises, compare the fee structures of different brokers before making a decision. Some brokers may charge a fixed fee per trade, while others may offer a tiered fee structure based on your trading volume. Additionally, consider other costs such as deposit and withdrawal fees, inactivity fees, and any fees associated with using specific trading tools or features. A broker with transparent and competitive fees is more likely to provide a better trading experience and contribute to your overall success as a trader.

The quality of customer support and the overall user experience are also crucial factors to consider when choosing a crypto broker in Bahrain. A reliable broker should offer professional, responsive, and efficient customer support through various channels such as live chat, email, and phone. The broker’s platform should also be user-friendly, with a clean interface and easy navigation. This ensures that both new and experienced traders can quickly understand and navigate the platform.

When evaluating the user experience, consider the availability of resources such as educational materials, market analysis, and trading tools. These resources can help you make informed trading decisions and enhance your overall trading experience. By considering these key factors, you can choose a reliable and secure crypto broker in Bahrain that meets your specific trading needs and preferences. And remember, a happy trader is a successful trader!

When hunting for the perfect crypto broker in Bahrain, usability and ease of navigation should be high on your priority list. A top-notch platform must cater to both newbies and experienced traders alike, with a user-friendly interface, intuitive menus, and smooth trading processes.

On a side note, who doesn’t love a bit of personalization? Look for a platform with customizable features, like rearranging panels or tweaking the layout. It’s like creating your own trading paradise, focusing on what matters most to your strategy.

Let’s face it: we live in a fast-paced world where trading on-the-go is a must-have. So, pick a crypto broker with a stellar mobile app or a mobile-responsive platform. Double-check that it’s compatible with your device (iOS or Android) and that it offers a seamless user experience.

When evaluating a broker’s mobile prowess, keep an eye on the app’s features and functionality. The mobile app should be like the web-based platform’s little sibling, with all the same bells and whistles, like charting tools, trade execution, and account management. Plus, it should keep you in the loop with real-time market data, news, and alerts. Who wouldn’t want a personal crypto assistant in their pocket?

In a nutshell, when comparing crypto broker platforms in Bahrain, focus on platform usability and ease of navigation, mobile trading capabilities and app availability, and the availability of advanced charting tools and educational resources. With these factors in mind, you’re sure to find a broker that meets your needs and makes your trading experience a breeze. Happy hunting!

Crypto brokers offer a variety of account types to cater to the diverse needs of their clients. These account types often come with different features and services, depending on the trader’s experience, trading style, and investment goals. Some common account types include:

Make sure to choose an account type that aligns with your trading needs and preferences. Read the broker’s account specifications and compare the services offered before making a decision.

Margin trading allows traders to borrow funds from the broker to open larger positions than their account balance would allow. This is done using leverage, which amplifies both potential profits and losses. Leverage is expressed as a ratio, such as 2:1 or 10:1, indicating the amount of borrowed funds compared to your own capital.

For example, with a 10:1 leverage ratio, you can open a position worth $10,000 using only $1,000 of your own funds. While this can significantly increase your profit potential, it also increases the risk of losing your entire investment.

When choosing a crypto broker, it’s important to consider their margin trading and leverage options. Some brokers offer higher leverage ratios, while others may limit the amount of leverage available based on your account type or trading experience. Make sure to choose a broker with margin trading options that suit your risk appetite and trading strategy.

Short selling is a trading strategy that allows you to profit from a declining market. By short selling a cryptocurrency, you’re essentially borrowing it from your broker and selling it in the market, with the expectation of buying it back at a lower price to return to the lender. If the cryptocurrency’s value decreases, you can buy it back for less, making a profit on the difference.

Some crypto brokers also offer access to advanced trading strategies, such as algorithmic trading and social trading. Algorithmic trading involves using pre-programmed trading algorithms to execute trades automatically based on specific market conditions. Social trading allows you to follow and copy the trades of experienced traders, potentially helping you learn and improve your trading skills.

When selecting a crypto broker, consider the availability of advanced trading strategies, such as short selling, algorithmic trading, and social trading. These options can provide you with more flexibility and opportunities to profit in the cryptocurrency market.

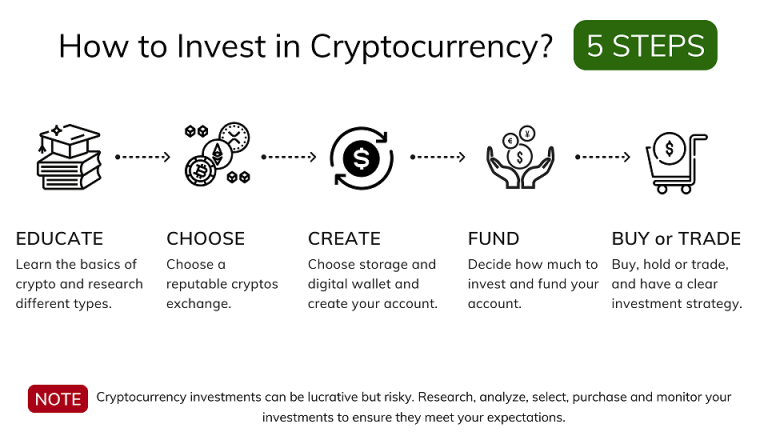

Before taking the plunge into the fascinating world of cryptocurrency trading, it’s crucial to assess your risk tolerance and set clear investment goals. Risk tolerance refers to the level of risk you’re willing to accept with your investments. It varies from person to person and is influenced by factors such as age, financial situation, and investment experience.

To determine your risk tolerance, consider how much money you’re willing to lose in a worst-case scenario, and how much volatility you can stomach in your investments. Once you have a clear understanding of your risk tolerance, you can set realistic investment goals. Your goals should be specific, measurable, and achievable within a given time frame. For instance, you might aim to achieve a 10% return on your investment within six months or to double your investment within two years.

To trade cryptocurrencies effectively, you need to have a fundamental understanding of the underlying technology – blockchain. Blockchain is a decentralized, digital ledger that records transactions in a secure, transparent, and tamper-proof manner. This technology is the backbone of cryptocurrencies such as Bitcoin and Ethereum.

Start by familiarizing yourself with the basics of blockchain technology, including concepts like distributed ledgers, consensus mechanisms, and smart contracts. This will help you grasp the nuances of different cryptocurrencies and their potential for growth.

Additionally, research the various types of cryptocurrencies available in the market, their use cases, and the problems they aim to solve. Understanding the market dynamics, including factors affecting cryptocurrency prices, can help you make informed investment decisions.

A well-defined trading strategy is essential for success in the volatile world of cryptocurrencies. Your strategy should outline your objectives, risk tolerance, and the specific trading techniques you’ll use to achieve your goals. Here are some steps to create a comprehensive crypto trading plan:

By following these steps, you can create a solid foundation for your cryptocurrency trading journey. With a clear understanding of your risk tolerance, investment goals, and a well-defined trading strategy, you’ll be better prepared to choose the right crypto broker in Bahrain that aligns with your needs and preferences. Remember, fortune favors the prepared!