If you’re interested in cryptocurrency and live in Bahrain, this guide is for you. Here, we’ll cover everything you need to know about crypto in Bahrain, including regulations, exchanges, and how to buy and sell. Whether you’re a seasoned trader or just starting out, this guide has got you covered.

Located in the Persian Gulf, the small island nation of Bahrain is making a big splash in the cryptocurrency and blockchain space. The country’s government has realized the potential of digital assets and the underlying technology to revolutionize the financial sector and boost economic growth. As a result, Bahrain has established itself as a regional hub for FinTech and digital innovation.

One of the critical drivers behind the growth of the cryptocurrency market in Bahrain is the Central Bank of Bahrain (CBB), which has implemented a forward-looking regulatory framework to facilitate the growth of the digital asset industry. This proactive approach has attracted several local and international players to establish their operations in the country, leading to a vibrant and growing ecosystem. Who knew that such a small island could have such a big impact?

The Central Bank of Bahrain has been at the forefront of regulating the cryptocurrency market, focusing on creating a conducive environment for innovation while ensuring investor protection and financial stability. The CBB has introduced a comprehensive set of rules for licensing and regulating crypto-asset services, making Bahrain one of the first countries in the region to adopt a clear regulatory framework for the industry.

In 2019, the CBB issued the Crypto-Asset Module (CAM), a comprehensive rulebook governing the operations of crypto-asset businesses. The CAM covers various aspects of the industry, including licensing requirements, governance, risk management, customer due diligence, and cybersecurity. This regulatory framework has set the stage for the development of a secure and transparent crypto ecosystem in Bahrain. Talk about being ahead of the curve!

Furthermore, the CBB has established a regulatory sandbox to encourage innovation and experimentation in the FinTech space. The sandbox provides a controlled environment for start-ups and established companies to test their innovative solutions and business models with a limited number of customers and reduced regulatory requirements. Several cryptocurrency and blockchain companies have utilized this sandbox to refine their products and services before launching them in the market. It’s like a playground for crypto enthusiasts!

The Bahraini government’s support for blockchain technology and digital assets goes beyond the regulatory framework. The country has launched several initiatives and partnerships aimed at fostering innovation, developing local talent, and attracting global expertise.

In a nutshell, Bahrain’s proactive approach to regulating the cryptocurrency market, coupled with its various initiatives and partnerships, has created a vibrant and supportive environment for the growth of the digital asset industry. The country’s progressive stance on blockchain technology and digital assets positions it as a regional leader in the rapidly evolving world of cryptocurrencies. So, if you’re thinking about dipping your toes into the crypto waters, Bahrain might just be the place to start!

In Bahrain, a plethora of cryptocurrency exchanges are available to facilitate the buying and selling of digital assets. Some of the most popular exchanges are Rain, Binance, Kraken, and BitOasis. Rain, a Bahrain-based exchange, has received a Crypto-Asset Module (CRA) license from the Central Bank of Bahrain (CBB), making it the first regulated exchange in the region. Binance, Kraken, and BitOasis are international exchanges that also cater to the Bahraini market, offering a vast array of cryptocurrencies and trading pairs to choose from.

Each of these exchanges comes with its own unique features and advantages. Rain, being locally based, allows users to trade in Bahraini Dinar (BHD) and places a strong emphasis on security and compliance. Binance is renowned for its extensive selection of cryptocurrencies and trading pairs, while Kraken is applauded for its user-friendly interface and strong security measures. BitOasis, on the other hand, is a popular choice among users in the Middle East due to its localized services and support for various local currencies, including the Bahraini Dinar.

Choosing the right cryptocurrency exchange for your needs depends on several factors. Here are some key aspects to consider when making your decision:

Payment methods for buying and selling cryptocurrencies in Bahrain typically include bank transfers, credit/debit cards, and some e-wallet services. The availability of these methods may vary depending on the exchange you choose. Generally, bank transfers are the most common and cost-effective option, while credit/debit card transactions tend to have higher fees but offer faster processing times.

Fees associated with buying and selling cryptocurrencies can be divided into three categories:

By understanding the various exchanges available in Bahrain, their unique features, and the associated fees, you can make an informed decision on the best platform for your cryptocurrency trading needs. So go ahead, dive into the world of cryptocurrencies, and may the trades be ever in your favor!

In the exciting world of cryptocurrencies, securing your digital assets is a top priority. Just like guarding a treasure chest, you need to protect your investments from theft, hacking, and other cyber threats. In Bahrain, as in any other country, having a secure and reliable cryptocurrency storage solution is crucial to safeguard your precious digital wealth.

A cryptocurrency wallet acts as a digital fortress that stores your private keys, which are required to access and manage your digital assets. By ensuring that your private keys are protected and inaccessible to unauthorized individuals, you can minimize the risk of losing your cryptocurrencies to hackers, scammers, or even human error (oops!).

Moreover, a secure cryptocurrency storage solution also helps protect your privacy and anonymity, as it reduces the likelihood of your transactions being tracked or traced. In Bahrain, where the government is proactively promoting the use of cryptocurrencies, it is particularly essential for users to maintain the security and confidentiality of their digital assets (shhh, it’s a secret).

There are various types of cryptocurrency wallets available in Bahrain, each with its unique features and security measures. It’s like a buffet of digital safes! Here’s a comparison of the most common wallet types:

1. Hot Wallets: Hot wallets are connected to the internet, making them more convenient for frequent transactions. They are usually free and easy to set up (like a walk in the park). Examples of hot wallets include online wallets, mobile wallets, and desktop wallets. However, their constant internet connectivity makes them more vulnerable to hacking and cyberattacks (think of them as digital daredevils).

1. Cold Wallets: Cold wallets are not connected to the internet, providing an additional layer of security against cyber threats. They are best suited for long-term storage of cryptocurrencies (like a digital time capsule). Examples of cold wallets include hardware wallets and paper wallets. While hardware wallets can be expensive, they offer better security compared to hot wallets. Paper wallets, on the other hand, are free but require careful handling to prevent damage or loss (don’t spill coffee on them!).

1. Custodial Wallets: These wallets are managed by third-party companies, such as cryptocurrency exchanges. Users do not have control over their private keys, making them less secure than non-custodial wallets. However, they are often more user-friendly and may offer additional services like trading and staking (a bit like having a digital butler).

1. Non-Custodial Wallets: In non-custodial wallets, users have full control over their private keys, ensuring greater security. These wallets can be hot or cold and are suitable for those who prioritize privacy and self-sovereignty (digital independence, anyone?).

Selecting the right cryptocurrency wallet in Bahrain is like finding the perfect pair of shoes – it depends on various factors, including your investment goals, preferred level of security, and the type of cryptocurrencies you own. Here are some tips to help you choose the best wallet for your needs:

1. Determine your needs: Consider how frequently you will be transacting and whether you require a wallet for multiple cryptocurrencies or just one. If you plan on trading frequently, a hot wallet might be more suitable, while a cold wallet is better for long-term storage.

1. Evaluate security features: Assess the security measures offered by each wallet, such as two-factor authentication, multi-signature support, and regular software updates. Cold wallets generally provide higher security, but you should still research the specific features of each wallet option (knowledge is power!).

1. User-friendliness: Choose a wallet that is easy to use and has a user-friendly interface. If you are new to cryptocurrencies, you might prefer a wallet with a simple design and clear instructions (no rocket science required).

1. Customer support and community: Opt for a wallet with a responsive customer support team and an active user community that can assist you in case you encounter any issues (it’s like having a digital support group).

1. Reputation and reviews: Research the reputation of the wallet provider and read user reviews to ensure that you are choosing a reliable and trustworthy solution (no one wants a sketchy digital safe).

By carefully considering these factors, you can select the most suitable cryptocurrency wallet for your needs in Bahrain, ensuring the safety and security of your digital assets (happy investing!).

As the crypto craze sweeps Bahrain, a growing number of businesses are boldly embracing digital asset payments. Here are some sectors where cryptocurrency is making its mark:

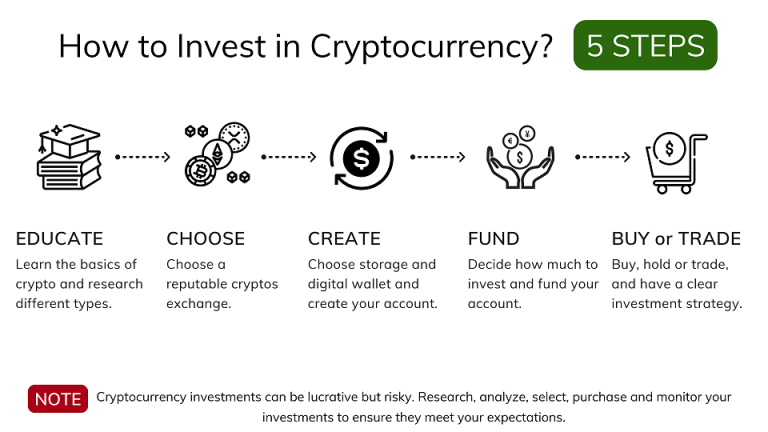

Could cryptocurrencies be the future of remittances in Bahrain? They offer a fast, secure, and cost-effective alternative to traditional money transfer services. Here’s a step-by-step guide to using digital assets for remittances and cross-border transactions:

While cryptocurrencies have their perks, they also come with challenges and opportunities to consider:

Challenges:

Opportunities:

In Bahrain, gambling is strictly prohibited by law, which includes both land-based and online gambling. This ban extends to betting and gambling using cryptocurrencies as well. The Central Bank of Bahrain (CBB) has issued a clear stance on cryptocurrency regulations, mainly focusing on the technology’s potential for financial services and fintech startups.

However, there is no explicit regulation for or against the use of cryptocurrencies for betting and gambling. The absence of specific regulations creates a grey area for crypto-based gambling, making it a risky endeavor for residents of Bahrain. Those who decide to participate in such activities should be aware of the potential legal consequences and proceed with caution.

Despite the legal risks, there are several popular cryptocurrency betting platforms available to Bahraini residents. These platforms offer a range of betting and gambling options, including sports betting, casino games, and live dealer games. Some of the most popular platforms include:

While participating in cryptocurrency betting and gambling in Bahrain may come with legal risks, those who choose to engage in these activities can follow certain guidelines to ensure a safe and responsible experience: